Our club will invest

€30 million in 2025!

The mission: to open the doors to the world of startup investing. Secure your membership: apply today.

By clicking, I confirm that I have read and accepted the privacy policy.

With access to nearly all the companies raising funds in the country, we apply a strict investment policy.

The club invests every 2-4 weeks in a carefully selected European company.

0.5% 0.5%

of startups that apply receive funding

Every week, we review hundreds of projects. The most promising receive funding from our club after a thorough selection process. Our investment analysts are committed to finding the most promising startups.

We conduct an in-depth initial evaluation, assessing five crucial factors: the team, the project, the market, the financial aspects, and the proposed deal terms. From there, we select the two or three projects we believe have the highest potential.

Audit Audit

for each deal, through comprehensive due diligence.

Once the projects are selected, we conduct a complete audit on these companies with our multidisciplinary team of analysts.

This meticulous due diligence phase ensures that everything is in order on 10 key aspects: the startup's history, its ownership structure, the team, the market, the business model, commercial traction, business strategy, financial analysis, the funding round and exit strategy, and legal audit.

Exclusive Exclusive

and preferential terms negotiated for everyone.

Our legal team negotiates the best possible legal terms. The shareholder agreement, which covers all clauses, is extremely protective of club members, as members benefit from the same investment terms that Jon and Thomas receive in every funding round.

We represent the Club in the startup’s equity and offer long-term support to entrepreneurs, up until an event that could generate significant liquidity for all co-investors.

Your money.

Your choice.

1 1

Explore the investment opportunities

With all the information you need to make a decision: pitch deck, key figures, club analysis, and a live pitch with the startup’s founders.

2 2

Set your investment amount

Choose which startup to invest in. Between €1,000 and €100,000 per opportunity.

3 3

Confirm your investment

Sign online and proceed with the payments corresponding to your allocation. It’s quick and simple.

4 4

We handle the formalities

Our legal team will take care of everything for you. You’re in good hands!

5 5

Congratulations!

You are now officially a shareholder.

You will own shares in startups.

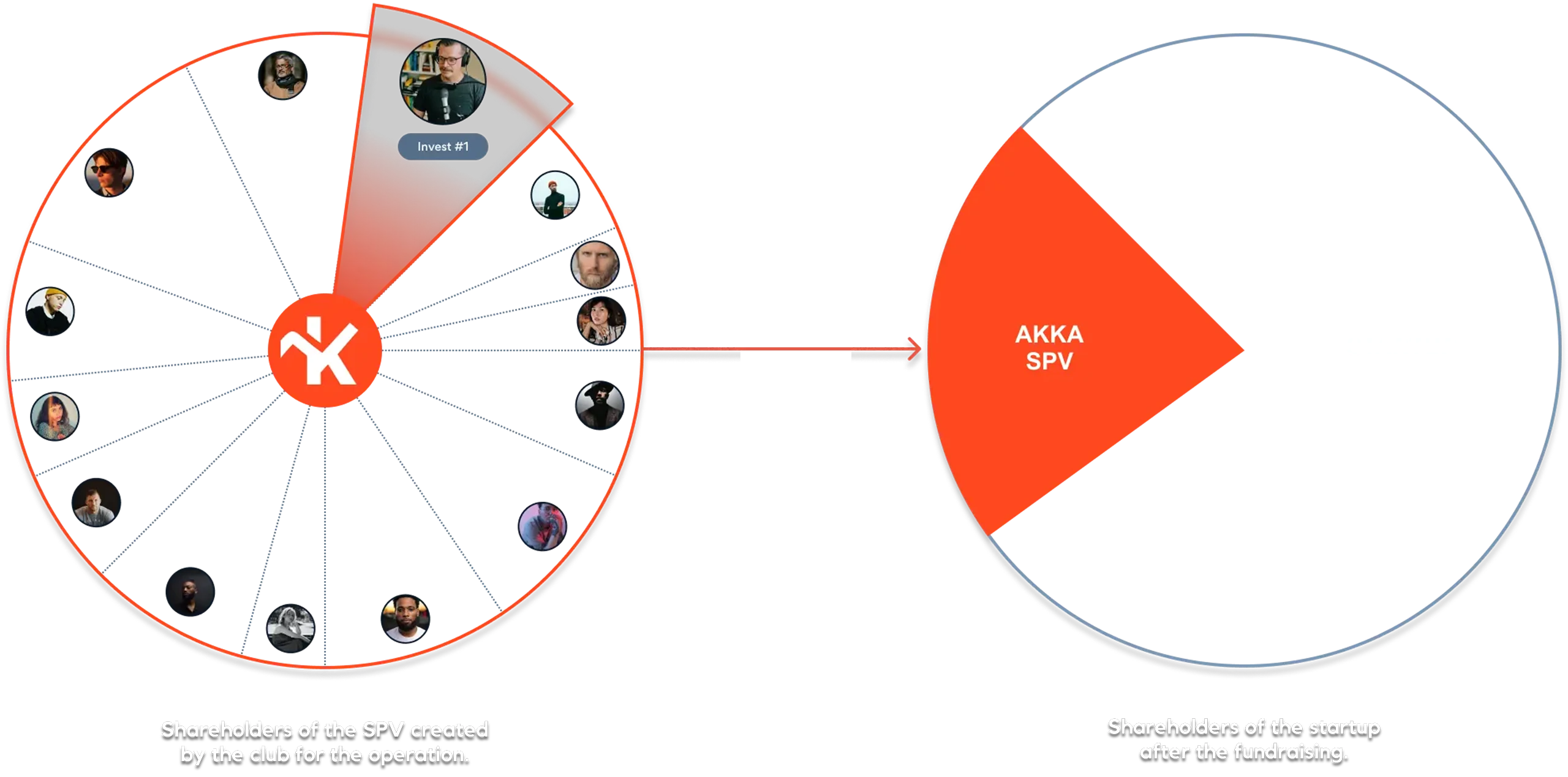

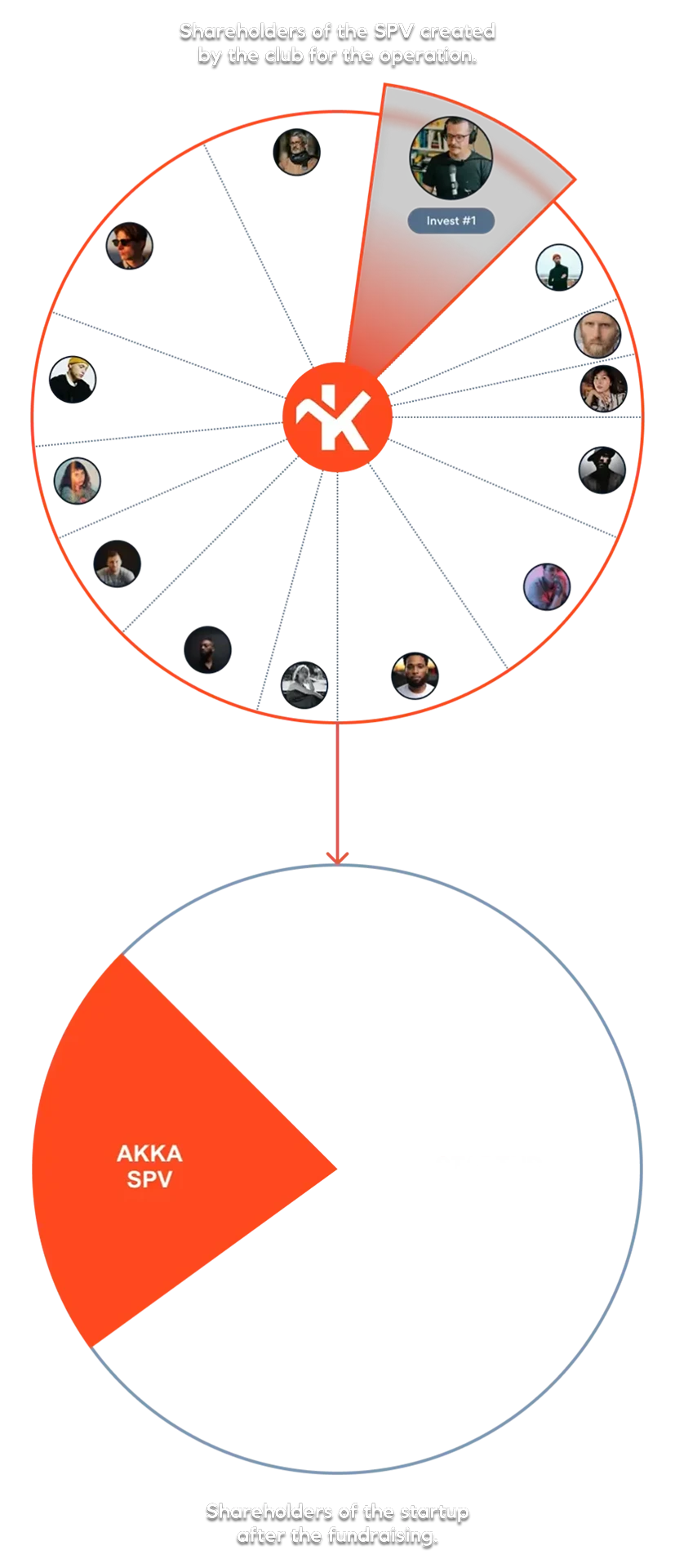

Every time our club raises funds, we bring together investors in a vehicle created specifically for the operation: an SPV (Special Purpose Vehicle).

When you invest in a startup with the club, you become a shareholder in that startup through the SPV dedicated to the operation.

A transparent fee structure

Like investment funds, we charge a performance fee of 20% on the profits earned by investors. In short, the more you earn, the more we earn. Our interests are perfectly aligned!

Structuring fee

From

3%

to

5%

Depending on your membership level, you pay a percentage for each investment.

Management fee

5%

Charged to the SPV dedicated to the operation.

Performance fee

20%

You pay once, and only if you make capital gains from the resale.

We only earn if you earn.

An Investment Club like no other

Better, Faster & Stronger than any VC

Investment Fund

you want to invest in

on all investments

depending on memberships

for 10 years

Performance Fee on Profits

Deal Analysis & Reports

Live Q&A with Founders

Access to Worldwide Deals

Access to Investment Experts

Direct Line with Founders

Networking Events

VIP Events

Club Directory

Afterworks

Akkademy training program

Private Discord Server

From €1,000 per year

Deal Analysis & Reports

Investment Fund

Investment Fund

you want to invest in

Investment Fund

decides for you

depending on

memberships

Investment Fund

for 10 years

Investment Fund

Deal Analysis & Reports

Live with Founders

Access to Worldwide Deals

Access to Investment Experts

Direct Line with Founders

Networking Events

VIP Events

Club Directory

Afterworks

Akkademy training program

Private Discord Server

Investment Fund

Deal Analysis & Reports

Don’t be left out! Apply now to become a member.

By clicking, I confirm that I have read and accepted the privacy policy.

From 7:00 PM to Midnight (CET). Seats are limited.